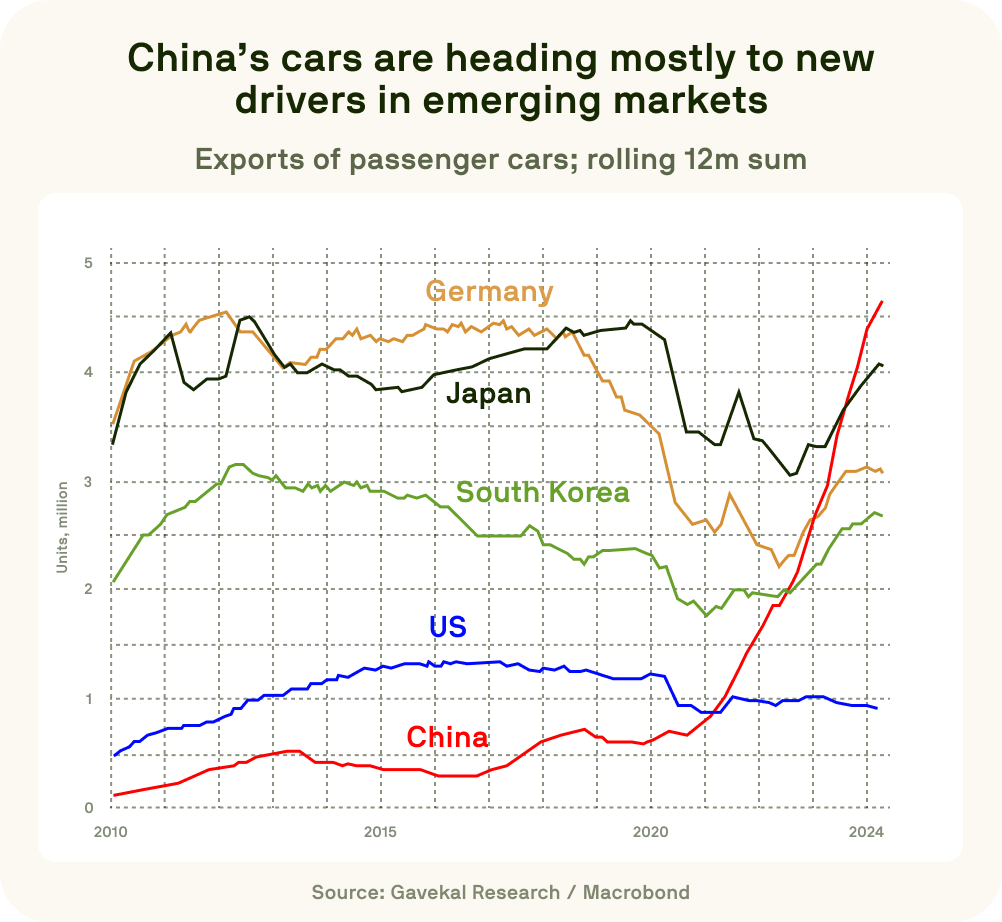

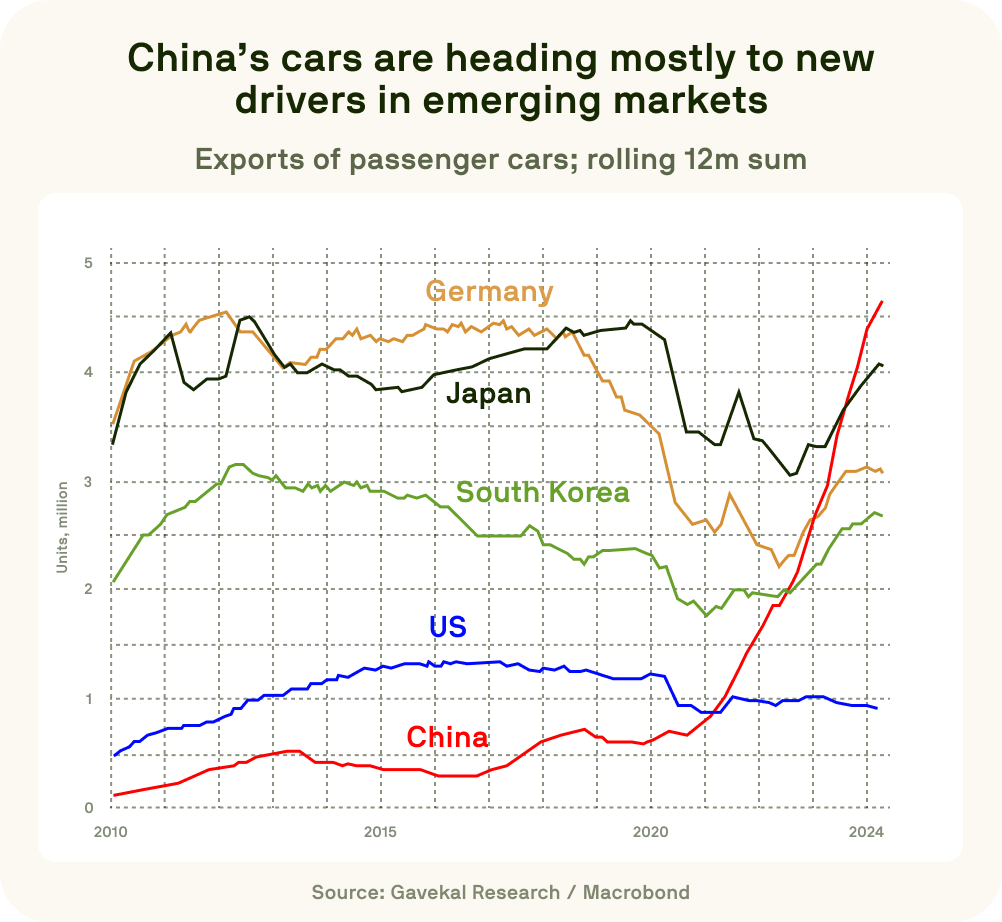

In 2024, Chinese EV giant BYD sold over 1.8 million vehicles, surpassing Tesla and setting a new benchmark in the global automotive market. These numbers mark a historic power shift, as a Chinese manufacturer claims the EV throne for the first time, where Chinese manufacturers are now leading the charge. European automakers, long dominant in the global automotive market, now face an existential challenge in the transition to electric vehicles. The solution lies in adopting innovative strategies and tools to optimize costs, foster collaboration, and enhance sustainability. These changes will determine whether Europe can maintain its position as a global automotive leader.

The Rise of China's EV Empire

China’s rise in the EV market is no accident. It stems from a combination of government support, technological advancements, and aggressive market expansion strategies. The Chinese government has played a crucial role by heavily investing in the EV sector through subsidies, tax breaks, and infrastructure development, thereby creating a fertile environment for growth. These policies have not only fueled the success of companies like BYD, but have also positioned China as a global leader in EV innovation.

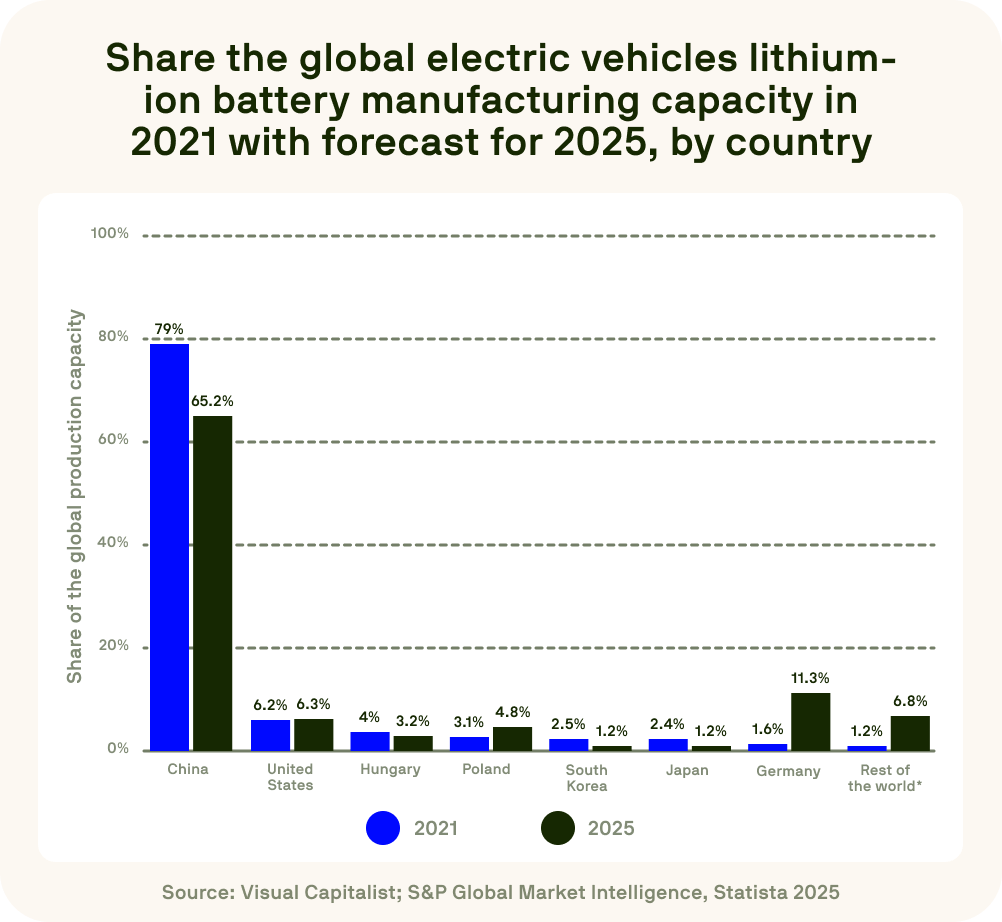

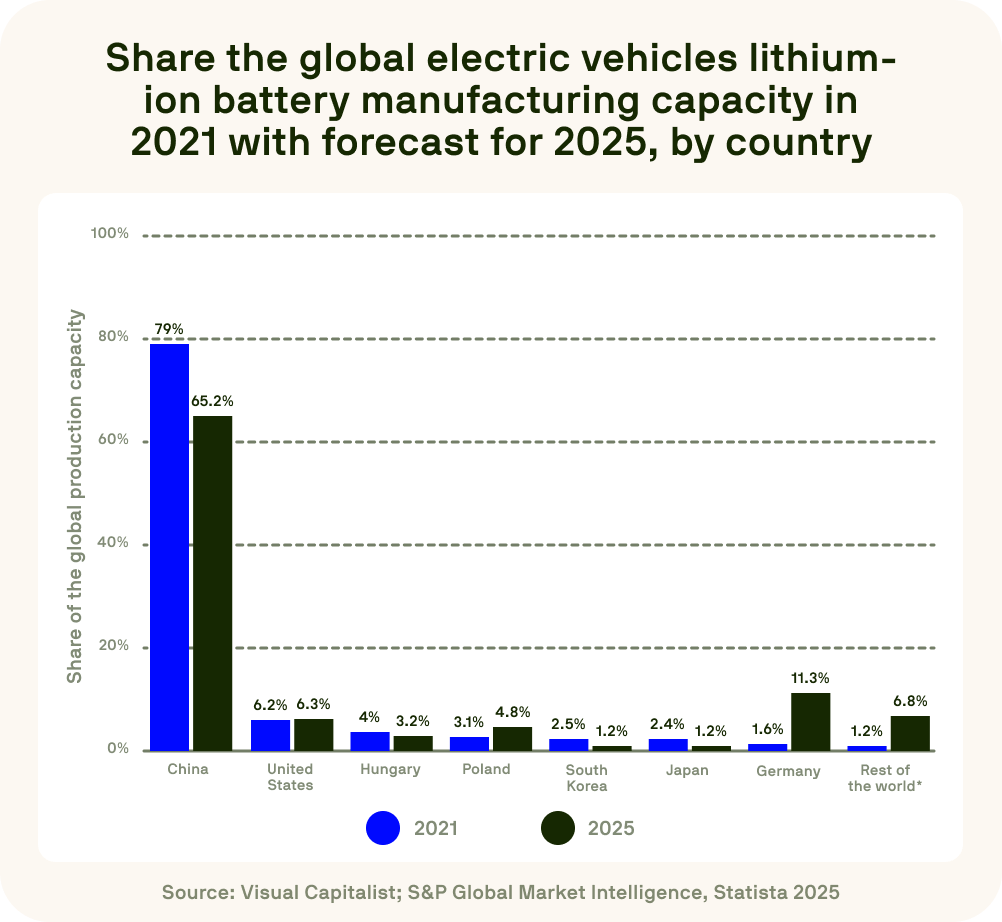

Chinese manufacturers have also leveraged their strengths in battery technology and production efficiency. BYD, for instance, has achieved vertical integration by producing its own batteries and chips. This approach has significantly reduced costs and boosted competitiveness, which allowed Chinese EVs to offer high quality at affordable prices. This competitive edge has enabled companies like BYD to expand beyond China, with their acquisition of Hedin Mobility in Germany marking a bold step into the European market.

Market Realities: Europe's Response to the EV Challenge

The rise of China’s EV manufacturers has disrupted Europe’s automotive sector, leaving many established players scrambling to adapt. Germany, Europe's traditional car-making powerhouse, saw its EV sales fall by 27% in 2024. This sharp decline shows how European manufacturers are struggling to compete. These companies face the dual challenge of competing with cost-efficient Chinese alternatives while maintaining their reputation for premium quality and innovation.

Europe's automotive sector is already mounting its response. Several European automakers are taking steps to regain their competitive edge. Stellantis and China’s CATL have committed €4.1 billion to building one of Europe’s largest EV battery factories in Spain, a move aimed at securing a steady supply of advanced batteries and reducing reliance on imports. Similarly, Hyundai has pledged $16.6 billion to advance EV and hydrogen technologies, reinforcing its commitment to sustainable innovation. In the UK, JATCO’s newly opened facility in Sunderland is set to produce advanced 3-in-1 EV powertrains for Nissan.

These developments show European manufacturers actively rebuilding their competitive position in the global EV market. By prioritizing sustainability, innovation, and localized production, they are beginning to address some of the challenges posed by global competition. Yet, these efforts alone may not be sufficient. The rapid pace of change in the EV industry demands more than incremental improvements. To survive and thrive, European automakers should embrace a comprehensive strategy that includes optimizing costs, fostering deeper collaboration with suppliers, and investing in research and development.

This need for a more proactive and strategic approach sets the stage for exploring how European manufacturers can position themselves for long-term success by balancing their premium quality with market-competitive pricing.